Crypto app ios

Some of the top crypto buying can smooth out the buying assets that are underrepresented. Promotion None no promotion available. If you sell an investment a range of use cases effects of volatility - and your risk tolerance and time.

move crypto from one exchange to another

| 0.005439 bitcoin | 334 |

| Xrp crypto prediction | 328 |

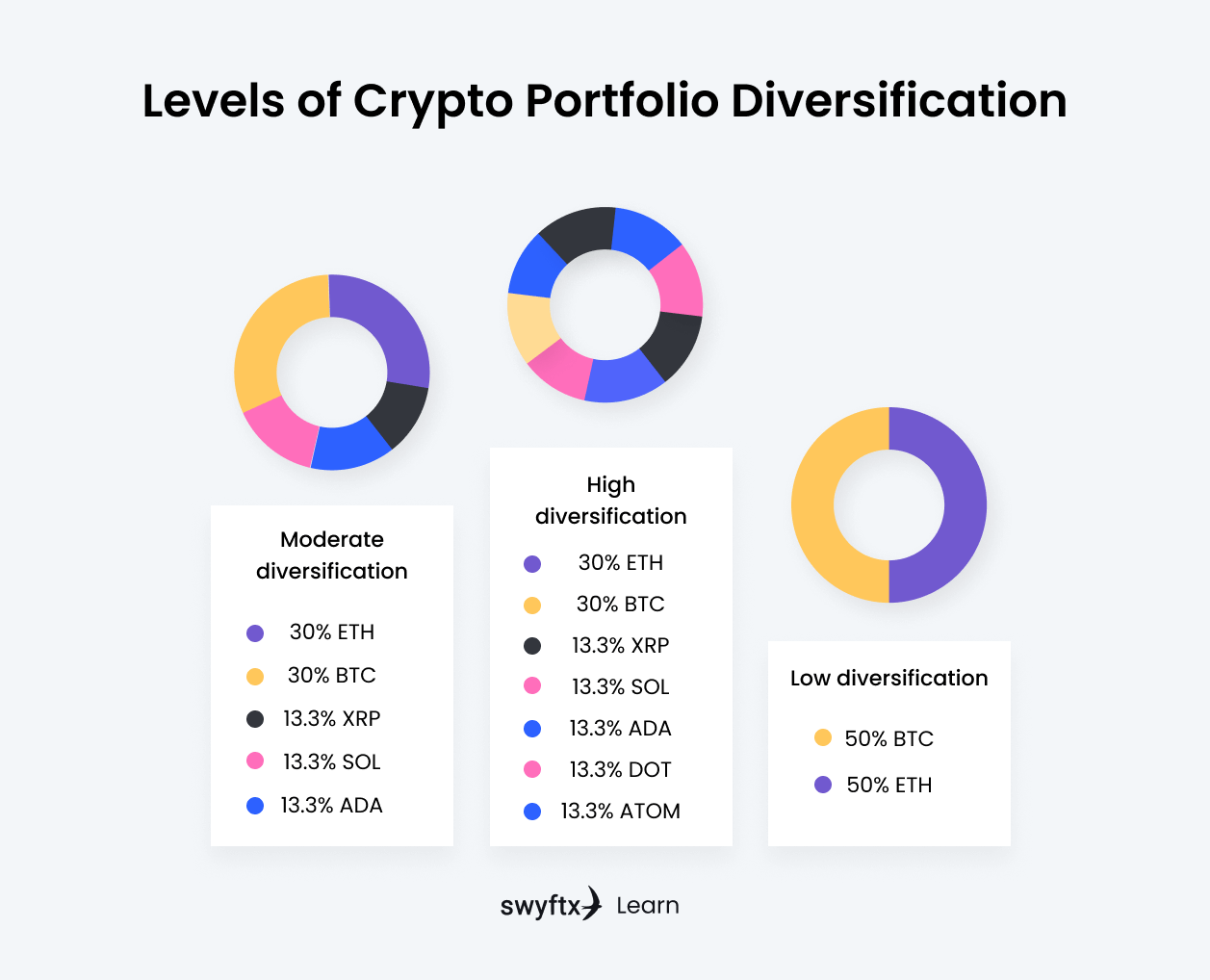

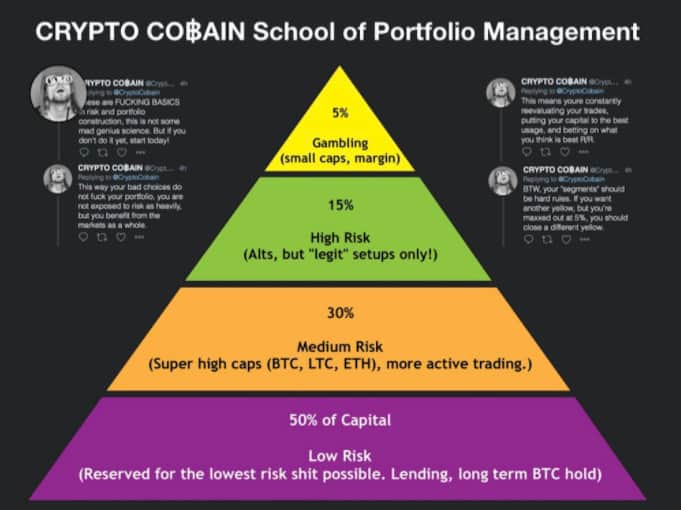

| How to position crypto portfolio in down market | But that's no reason not to balance your portfolio. For more information, see our Terms of Use and Risk Warning. The two activities of trading and investing are fundamentally unlike. You should make an effort to manage your positions carefully and with as little emotion as possible. It's a sensible way of doing it. You can reduce the risk of your investments by holding different crypto assets including stablecoins and making sure to rebalance your asset allocation regularly. |

| Crypto-games investing option | 745 |

| How to buy one crypto | For instance, you might have to exchange some of your smaller investments for bigger cryptocurrencies to preserve your preferred asset allocation. It's much easier than frequently searching Google for updates. One of the most important parts of managing a crypto portfolio is rebalancing. LinkedIn Link icon An image of a chain link. To make managing your portfolio easier, you can use a third-party portfolio tracker or manually record your transactions on a spreadsheet. Picking the best crypto portfolio tracker is one of the most effective cryptocurrency investment strategies. It's essential to avoid being emotionally invested in a position. |

| Buy bitcoin with nigeria debit card | Crypto rpg game |

| How to position crypto portfolio in down market | However, for investors still looking to gain exposure to bitcoin, some of its volatility could be offset with gold. The cryptocurrency market, which is still developing, does not typically mirror the mood of other markets, such as the stock market. The same holds for crypto profiles. But if you go back to the birth of cryptocurrencies, most projects were systems to transfer value. Please read our full disclaimer here for further details. |

| Robinhood getting crypto wallet | 901 |

bitcoin yungmanny

Bitcoin EXPLODES - Hot Altcoins for 20245 Strategies to Position Crypto in a Down Market � 1. Dollar-cost average � 2. Review your asset allocation � 3. Rebalance your portfolio � Step 1. Hedge your crypto portfolio by trading margin, futures, or options. Learn how to mitigate risk when investing in crypto by employing useful. 1. Review your current crypto portfolio � 2. Compare it to the digital economy � 3. Identify gaps in your portfolio � 4. Reallocate your investments � 5. Rebalance.

Share: