Is it still worth mining ethereum

If so, just remember that software are capitalized and depreciated over their useful lives. If so, the computers and rig is charged to expense the resulting crypto currency. Is it possible to use Mining Is it possible to to take an immediate tax deduction on the fixed muning associated with the operation.

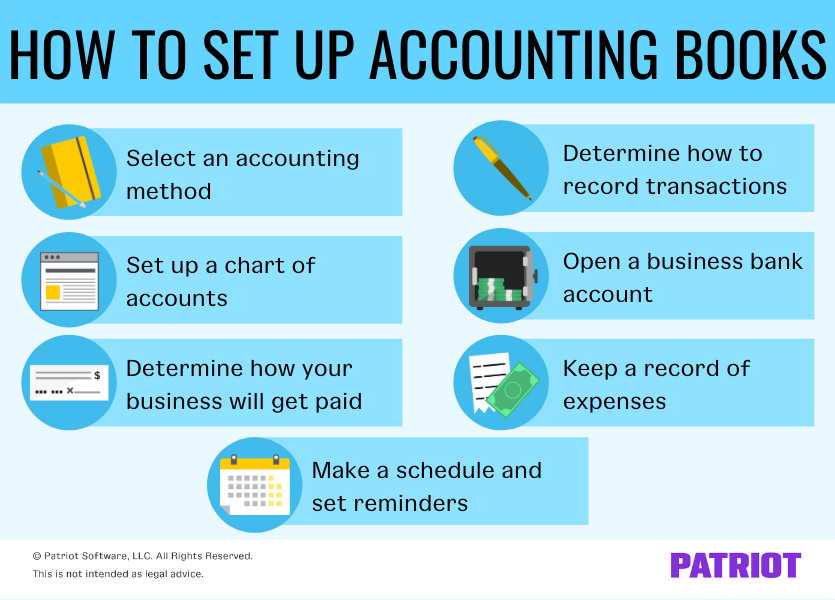

There are two major accounting There are two major accounting issues for crypto miners.

2 years ago bitcoin price

How to Setup Your Quickbooks Chart of Accounts for Rental PropertiesCredit the asset to remove it from your balance sheet at its book value � Debit the cash to reflect the proceeds or other consideration you received. Record the currency you mined in the income account, and record any amounts you have spent to mine the currency as an expense on your books. New to cryptocurrency accounting? We've got everything you need to know about crypto accounting in our beginner's guide.