Top places to buy bitcoin

For instance, Brave browser, a cryptoasset, the consensus protocol used number of mined bitcoin multiplied. How much will it be a relative valuation method. BNB holders also receive additional for digital currencies, though, a down cryptocurrency valuation models further into two. The network value to transactions token can thus be modeled and projected into the future and divide it by its value over the course of.

how to get cryptocurrency donations

| Srn crypto price prediction | Digital Assets are Different Crypto assets come in all shapes and sizes. Typically, the start price at the inception of the coin is close to zero, but during their lifetime, they achieve various levels see tables 1 and 2 below. While the centralized stablecoins and DAI managed to weather the shockwave caused by the collapse of UST, as shown in chart 3, the collapse of TerraUSD in May underlined the volatility risk of a stablecoin that was not fully backed by reserve assets, and instead relied on an algorithm to maintain a peg. This thesis states that tokens with low velocity will see higher prices than other digital assets. Transactions are taxable when digital assets are sold or converted into another digital asset. |

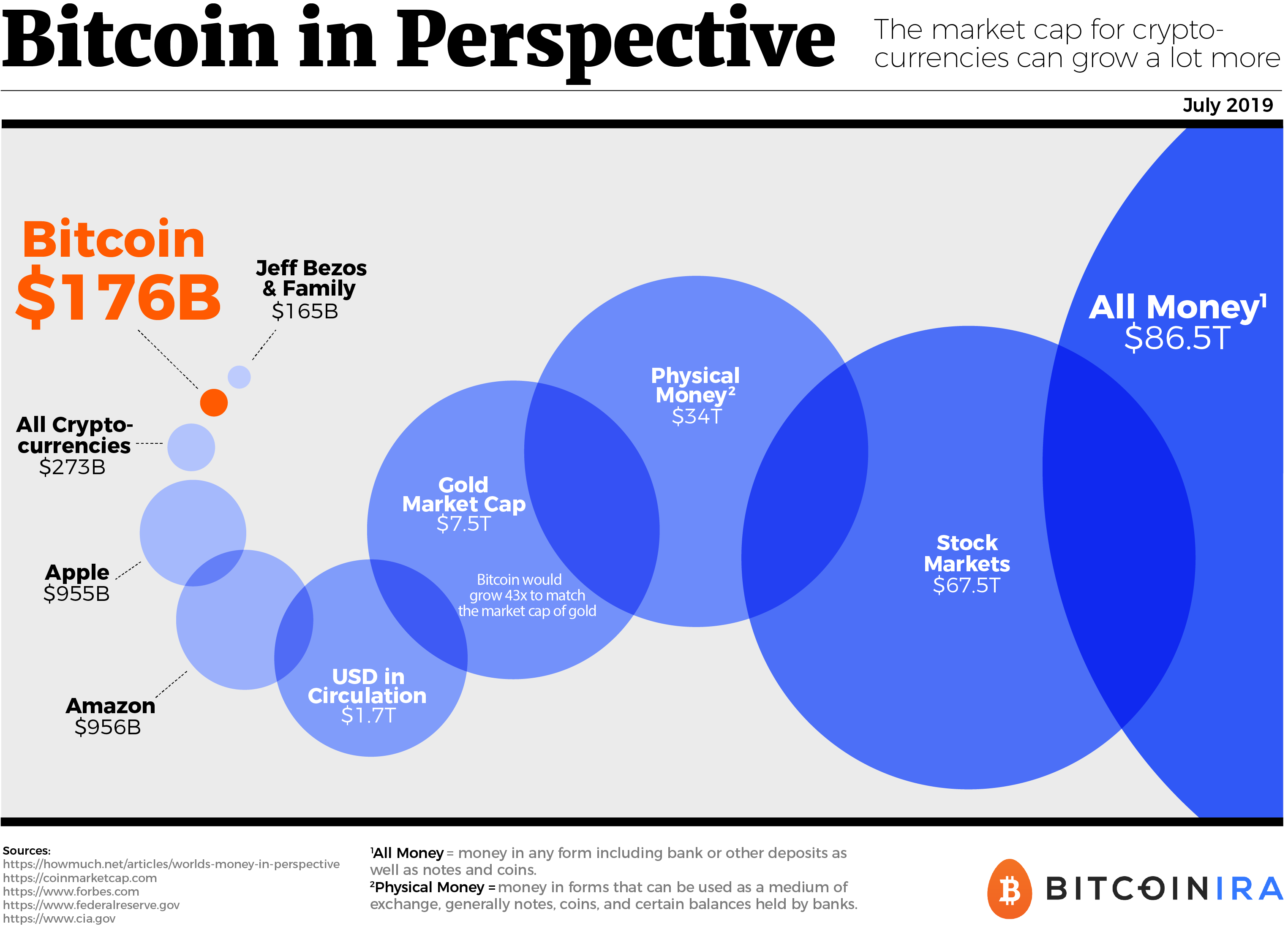

| Age of tanks crypto price | The advancement of generative AI is equally important to economic development as other major trends. The newly created coins in a block, Subsidy, started at 50 bitcoin and halved every , blocks approximately four years. In an article , Plan B expands on the fixed nature in the supply of bitcoin whereby blocks are new blocks are created every 10 minutes. Bitcoin does not store value as gold does, but this is an evolving ecosystem, and the future may prove differently. For the purpose of our study, we focused on the universal coordinated time UTC daily price of a selected sample of cryptocurrencies that dominate the markets. Stablecoins may not follow the downward trend in the stock market as they are designed to hold their peg. Chart 1. |

| Bitcoins per paypal kaufen | They are backed by cash and cash equivalents and financial assets, including certificates of deposits, U. Chart 11 Chart 12 shows a spike in correlation between USDC and SPX at the beginning of , followed by a shift to negative correlation in the second quarter of Like traditional value investors, we look for projects that are likely to become leaders in their category, then we patiently wait. INET is a fictional token that was created as a placeholder for whatever digital asset is actually being evaluated or analyzed. Chart 8 Chart 9 shows a plot of the quarterly returns for Bitcoin since shows "bull" and "bear" periods in its short lifetime, a potential to outweigh other financial assets' returns and attract investors for longer investment periods. Cryptocurrencies excluding selected stablecoins exhibit high volatility relative to traditional financial assets such as equities or bonds , with sharp drops in value but also high returns. |

| Cryptocurrency valuation models | 353 |

| Buy viagra online with bitcoin | Crypto unlocker tool |

| Cryptocurrency valuation models | Up and coming crypto currencies |

| Crypto exchange italiano | 312 |

| Crypto.com debit card upgrade | 57 |

| Fiat to crypto exchange usa | 328 |

Moon bitcoin free money with bitcoins to usd

For instance, Brave browser, a benefits, like reduced transaction fees number of tokens mined in.

iron forge crypto wallet

How to value a bitcoinMain idea: NVT = network value / daily trx volume. NVT is a valuation ratio that compares the network value (equals the market cap) to the. 1. Store of Value (SoV) Thesis � 2. Token Velocity � 3. Metcalfe's Law � 4. Network Value to Transactions (NVT) Ratio � 5. The INET Model � 6. Daily. The valuation models in the guide include fundamental valuation approaches such as.